impossible foods ipo reddit

Sources say the company may go public at a 10 billion valuation within the next 12 months via either SPAC or IPO. Today Impossible Foods is still a private company valued at roughly 4 billion in 2020 however they are currently in talks to go public in the next 12 months via IPO initial public offering or SPAC special purpose acquisition company.

Impossible Meat Preparing For A 10b Ipo R Investing

3Impossible Foods Inc is preparing to go public via SPAC or IPO route.

. The most recent price per share is 1615. The company which hosts the popular WallStreetBets subreddit has noticed an increase in the number of users and usage in 2021. We havent announced any plans to become publicly traded but you can be the first to get other Impossible updates by joining our mailing list.

Impossible also has a bigger fast food chain presence. In November 2021 Impossible Foods CEO Pat Brown said going public was inevitable The craze for plant-based meat substitutes continues to power on but valuation in these types of industries is always a concern. Impossible Foods has secured 500 million in a new funding round led by existing investor Mirae Asset Global InvestmentsOther existing investors unnamed at this time also participated.

Bureau of Labor Statistics reported today. This is a 4571 percent increase over losses of 140 per share from the same period last year. Impossible may have entered the scene later it was founded in 2011 Beyond in 2009 but in some ways it seems almost more prepared for an IPO.

One of the hottest IPOs in 2022 might be a company youve never heard of. The Impossible Foods IPO was first rumoured in April 2021 and was expected within 12 months. This funding round valued Impossible Foods at 7 billion.

There is no Impossible Foods IPO date yet. Impossible Foods latest funding round gave it a valuation of 403 billion in August. Impossible Foods is exploring options to go public either via traditional IPO or SPAC according to ReutersThe company is one of the largest in the plant-based food market and a main competitor.

Manhattan Street Capital best known for its Reg A securities offerings is pitching shares in Impossible Foods a competitor to Beyond Meat NASDAQBYND. The Consumer Price Index for All Urban Consumers CPI-U increased 08 percent in February on a seasonally adjusted basis after rising 06 percent in January the US. Impossible Foods is a company that is a public list that has been.

Its on menus at Burger King Qdoba and White Castle while Beyond has a smaller. Impossible foods is set on going public. If this is the case its worth far more than Beyond Meat was at the time of its listing the company secured a 146 billion market cap post-IPO.

The CEO of Impossible Foods said in late 2021 that an IPO was inevitable The companys expected valuation is expected to be around 20 billion nearly 10 times Beyond Meat when it went public. Impossible Foods has said it will eventually go public which could mean a 2022 IPO is likely to happen. Were privately held by a small number of investors.

July 14 2020 345 pm By JD Alois. Impossible foods ipo reddit. Some reports have the listing at as much as 10 billion although the valuation and size have not been confirmed publicly.

Data intelligence and artificial intelligence company Databricks landed a 16-billion funding round in August that valued the company at 39 billion. The Shanghai Stock Exchange on Friday suspended trading of two bonds issued by smaller developer Fantasia Group China Co with one dropping more than 50 after controlling shareholder Fantasia Holdings Group 1777HK missed the deadline on a 206 million international market debt payment on Monday. It brings the US companys total funding close to 2 billion according to a press release and values the company at 7 billion according to reports.

Press question mark to learn the rest of the keyboard shortcuts. Along with recent funds raised they have just introduced their first Women onto their board which was also done with Palantir as they announced their IPO. This is a 2558 percent increase over sales of 94200 million the same period last year.

The valuation at that time was noted at 10 billion. They are hoping to accomplish it within 12 months from April 2021. A round earlier in the year was at 361 billion.

Databricks One of the hottest IPOs in 2022 might be a company youve never heard of. One of the expected top IPOs of 2022 will likely be Reddit which recently filed confidential documents to make public. The company reported quarterly sales of 118 billion which beat the analyst consensus estimate of 112 billion by 563 percent.

The valuation at that time was noted at 10 Billion. Im thinking of investing in impossible foods. In November 2021 Impossible Foods secured 500 million in a new funding round led by Mirae Asset Global Investments.

Im looking at 34 a share at 10b valuation thats double their august 2020 valuation and roughly the same as the current market cap of beyond meat. Although Beyond Meat still trades well above its IPO price it suffered a huge 48 loss in 2021. Impossible Foods Inc was preparing for public listing as far back as April 2021.

What do we know about the Impossible Foods IPO. Thanks for your interest. Impossible foods has raised another 200 million increasing their total funds raised to 15 billion.

We closed a round of financing in November 2021 and dont currently have opportunities for direct investment. Now valuing them estimated over 4 billion. However recent reporting April 8th by Reuters indicates that the company has engaged financial advisors to better understand its valuation as it fields interest from several SPACs.

Impossible Foods has said it will eventually go public which could mean a 2022 IPO is likely to happen. From partnering with Burger King in the US to being Beyond Meats biggest direct competitor. It has raised 3875 million almost triple Beyonds pre-IPO 122 million.

Over the last 12 months the all items. They were considering both direct IPO listing and the SPAC route 34.

Impossible Foods Explores Spac Or Ipo R Spacs

Impossible Meat Preparing For A 10b Ipo R Investing

Impossible Foods Explores Spac Or Ipo R Spacs

10 Spacs That Could Bring Impossible Foods Public R Spacs

Reddit Impossible Foods Juvo Mobile Personal Capital Primary Data Unifyid Viome Smash Gg Flutterwave Ironclad Hustle Spaceiq Limelight Health Drive Motors And Botmetric Raise Funds Silicon Valley Business Journal

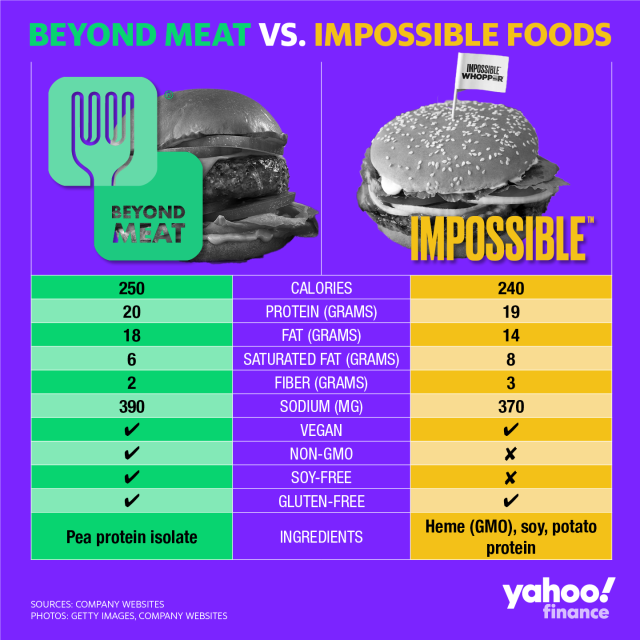

Beyond Meat Vs Impossible Foods Burger Nutrition Showdown

Impossible Foods Explores Spac Or Ipo R Spacs